Attracting and retaining coveted COIs: A giving hand is always full

In financial and professional services, your client and professional advocates (centers of influence) are incredibly important to the success of your business. The best have experienced the value you can offer or have intimate knowledge of the impact you’re having on others. While everyone would agree COIs can be as important as a client itself, most go about attracting additional sources all wrong.

Much of what we see among financial professionals is that they do their prospecting on a limited time budget. That’s reality. But what this is driving is a transactional approach to attracting coveted referral and introduction sources. In short, we see too much of a “take” mindset vs. a “give” mindset.

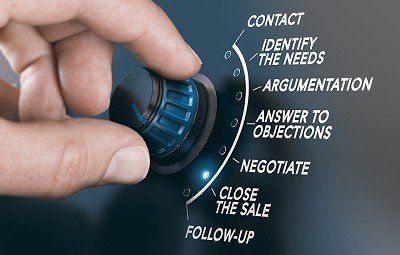

Renowned sales coach and author John Orvos, speaks to this concept. John is fond of saying “a giving hand is always full”. As a peer I’ve found this advice to be invaluable. As a friend, I’ve found it to be the best “retention tool” going. So when thinking about gaining more COIs in business, it’s about balancing two buckets – a give bucket and a take bucket. Managing your give bucket is about what you can offer COIs in terms of insights and eventually valuable introductions. Your take bucket holds what you can realistically ask of COIs, namely referrals and support for your business once earned.

It’s also important to note that there are two dimensions of time between you and your COI – time together and time apart. Face it, you are apart more than together so it’s important to drip on your COIs to let them know what you’re up to and to provide valuable insights for their business.

Let’s take a look at a few COI types:

Attorneys:

- Attorneys make money on transactions and the billable hours that result from them.

- Be attuned to transactions associated with the risks and business issues your firm can address.

- Attorneys need help prospecting – they don’t like to take time away from billable hours. Help them be successful.

Financial Planners:

- Financial planners (and most COIs) value your ability to provide expertise to their clients.

- They’re in the planning business – focused on future events. You’re in the same business!

Real Estate Professionals:

- Realtors value those moving into certain neighborhoods, neighborhoods where your ideal prospects reside.

- Be a net giver, tap into that information and know the inventory.

So here are 6 proven tips to attract and retain the best centers of influence for your practice.

- Ensure that the COI has a business model you can identify with.

If you cant get excited about their business, you will have very little to give in terms of insights, support, and ultimately referrals. Attorneys and CPAs make their living on billable hours – help them see the value in prospecting. Give them actionable ideas on how to do more in less time.

- Find a link between your value prop and theirs. Every one of your COIs, whether they be real estate professionals, financial planners or lawyers all have a value prop for their practice. While some are better than others, find the connection between how you both go to market. Some of the best CPA firms we’ve seen have done a great job of creating industry and market specialization and promote that heavily. There’s bound to be a connection there for you.

- Be their number one referrer. Make sure that you have a referral mindset - A “giving hand is always full”. Be on the lookout for their ideal client type.

- Support the networking events or social gatherings of your COI. The Woody Allen rule works in this case – there is high value in showing up. Put each one of your COIs on the mailing list for your events and functions.

- Share helpful insights that they can use to grow their business. Always update them on new developments in their industry that affect them, as well as what’s happening in yours. For example, help your real estate partners know the inventory in your market and share what your affluent clients are looking for as they look to live their life in your community, not just find a home.

- Keep a client type focus. Certain client types- such as serial entrepreneurs or retiring land owners– have unique problems, concerns and aspirations. Identify the client types you both serve, the problems you both address and the impact you’re having on solving those problems. Work that understanding into your messaging and support for one another.

For more information, visit https://www.billwaltonsalestraining.com